Binance vs. Coinbase : Compare fees, features, and security to find the best crypto exchange for low-cost trading in 2025. Discover which platform saves you more!

Crypto trading can feel like navigating a maze—prices bouncing, platforms promising the moon, and fees sneaking up when you least expect. When I started trading in 2019, I picked an exchange without checking costs and watched $10 vanish on a $50 trade. Ouch. That’s why, in 2025, choosing the right platform matters, especially if you’re chasing low-cost crypto trading. Binance and Coinbase are giants in the crypto world, each with millions of users and a reputation for reliability. But when it comes to saving money on trades, which one’s the champ? I’ve used both, made mistakes, and learned what works. This Binance vs. Coinbase showdown dives into fees, features, security, and more to help you pick the best crypto exchange for your wallet.

Why Low-Cost Trading Matters

Every dollar you save on fees is a dollar you can trade or HODL. Crypto exchange fees—whether for buying Bitcoin or swapping altcoins—add up fast, especially for active traders or those starting with small budgets like $100. In 2024, global crypto trading volume hit $108 trillion, and even a 0.1% fee difference can mean thousands over time. Binance and Coinbase both offer robust platforms, but their fee structures cater to different crowds. Binance is known for dirt-cheap trades, while Coinbase prioritizes ease for a price. Let’s break it down to see which delivers the best bang for your buck.

Binance vs. Coinbase at a Glance

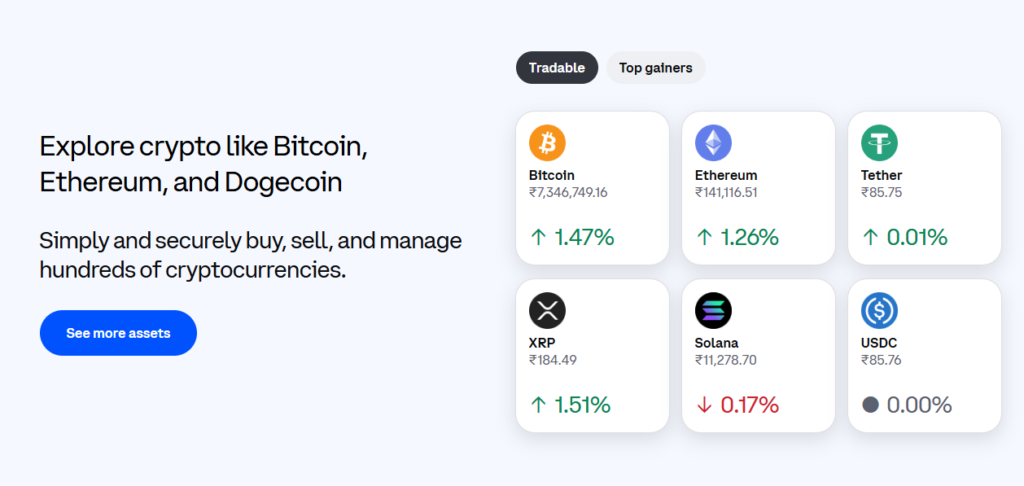

Before we dig into costs, here’s the lay of the land. Binance, launched in 2017, is the world’s largest exchange by volume, handling over $2 trillion monthly. It’s a powerhouse for traders who want options—600+ coins, futures, staking, even a crypto card. Coinbase, born in 2012, is the U.S.’s go-to, publicly listed on Nasdaq, with 200+ coins and a beginner-friendly vibe. Both are secure, support Bitcoin and Ethereum, and cater to millions. But low-cost crypto trading? That’s where they diverge.

Comparing Fees: The Heart of Low-Cost Trading

Fees are the make-or-break for most traders. Let’s see how Binance and Coinbase stack up in 2025.

| Feature | Binance Fees | Coinbase (Basic) Fees | Coinbase Advanced |

|---|---|---|---|

| Spot Trading Fee (Maker/Taker) | 0.1% / 0.1% | Spread (~0.5%) + Fee ($0.99–$2.99 or 1.49%) | 0%–0.6% based on 30-day volume |

| Fee with Token Discount | 0.075% (with BNB) | N/A | N/A |

| High-Volume Discount | As low as 0.02% for >$1M monthly volume | N/A | 0.4% (maker) / 0.6% (taker) for $10K monthly volume |

| Deposit Fees | Free for most methods | Free via bank transfer, 3.99% via card | Same as basic |

| Withdrawal Fees | Varies by coin (e.g., ~$5 for BTC) | ~$5 for BTC | Same as basic |

| Zero-Fee Perks | Select BTC pairs, occasional promos | None | None |

| Subscription Option | N/A | Coinbase One: $29.99/month, reduces fees | N/A |

| Ideal For | Low-fee, high-volume, or BNB users | Beginners making occasional trades | More active traders wanting better rates than the basic platform |

Fee Verdict of Binance vs. Coinbase

Binance wins hands-down for low-cost crypto trading. Its 0.1% base fee (0.075% with BNB) crushes Coinbase’s 0.4%-0.6% on Advanced or 1-2% on the basic platform. For a $100 trade, Binance might cost $0.10, Coinbase $1-$2. Over a year of weekly $100 trades, that’s $5 vs. $50-$100. Unless you’re trading tiny amounts and need Coinbase’s simplicity, Binance saves more.

Features: What You Get for Your Money

Low fees are great, but what do you actually get? A cheap platform’s no good if it’s clunky or lacks coins you want. Here’s how features compare.

| Feature Category | Binance | Coinbase |

|---|

| Coins Offered | 600+ cryptocurrencies (Bitcoin, Aptos, Hedera, and more) | 200+ cryptocurrencies (Bitcoin, Ethereum, Cardano, stablecoins) |

| Trading Options | Spot, Margin, Futures (up to 20x), Grid Trading | Spot trading only (Simple & Advanced interface) |

| Earn Products | Staking (up to 35% APY), Yield Farming, Launchpool | Staking (up to 12% APY, 25% commission), limited selection |

| Trading Tools | TradingView charts, stop-limit, OCO orders, “Lite” mode for beginners | Basic charts, limit orders in Advanced view |

| Extras | Binance Card, P2P trading, NFT marketplace | Coinbase Wallet, Learn-to-Earn program, Coinbase Card (U.S. only) |

| User Experience | Feature-rich but can be overwhelming for beginners; Lite mode available | Clean, beginner-friendly app and interface |

| Standout Feature | Extensive coin list & high APY staking (e.g., Solana at 10%) | Educational rewards + sleek user experience |

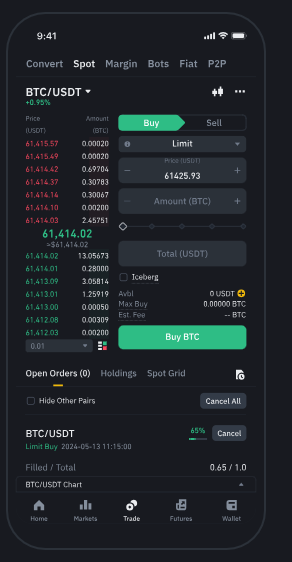

I love Binance’s staking—locked my Solana for 10% APY last year. But the interface? It’s packed. Newbies might feel lost among the charts and tabs, though Lite mode helps.

Coinbase’s app feels like a breeze—I bought Bitcoin in minutes my first time. But the lack of futures or margin limits pros, and staking fees cut into profits.

Features Verdict of Binance vs. Coinbase

Binance offers more—way more. Its coin variety, trading types, and earn options dwarf Coinbase’s simpler setup. For low-cost crypto trading, Binance’s features give active traders tools to maximize returns, while Coinbase suits those who want ease over depth.

Security: Keeping Your Funds Safe

Cheap trades mean nothing if your coins vanish. Both exchanges are battle-tested, but let’s check their armor.

| Security Feature | Binance | Coinbase |

|---|

| Two-Factor Authentication (2FA) | Yes – via app, SMS, or email | Yes – via app + biometric login (fingerprint/Face ID) |

| Cold Storage | Majority of user funds stored offline | 98% of crypto assets stored offline |

| Insurance Fund | SAFU (Secure Asset Fund for Users) – $1B+ reserve for emergency/hacks | Insurance against breaches (not user-side errors) |

| Fiat Protection | N/A | FDIC insurance for USD balances up to $250,000 (U.S. users) |

| Platform Transparency | Privately held; Binance.US operates under U.S. compliance | Publicly listed on Nasdaq – more regulatory oversight |

| Past Incidents | 2019: $40M hack, fully covered by SAFU | 2021: SMS-based attack on 6,000 accounts, quickly resolved |

| Extra Protections | Real-time monitoring, withdrawal delays on suspicious activity | Strong compliance, UK FCA-regulated, rapid response protocols |

| User Trust & Control | Users encouraged to use hardware wallets + security alerts | High trust due to regulatory backing and strong U.S. presence |

Security Verdict of Binance vs. Coinbase

It’s a tie. Both prioritize 2FA, cold storage, and quick fixes for breaches. Coinbase’s FDIC insurance and regulation edge out for beginners, but Binance’s SAFU and monitoring match up. For low-cost crypto trading, neither skimps on safety.

User Experience: Binance vs. Coinbase

A platform’s feel matters—nobody wants a headache trading $100. Let’s compare usability.

Binance User Experience

Binance’s dashboard is a beast—charts, pairs, and options galore. Advanced traders love the TradingView integration and customizable layouts. But for newbies? It’s like walking into a cockpit. The Lite mode simplifies things, showing just buy/sell basics, and the app’s smooth for mobile trades. I spent a week lost in menus early on but now zip through. Customer support (chat, X) is decent but can lag during rushes.

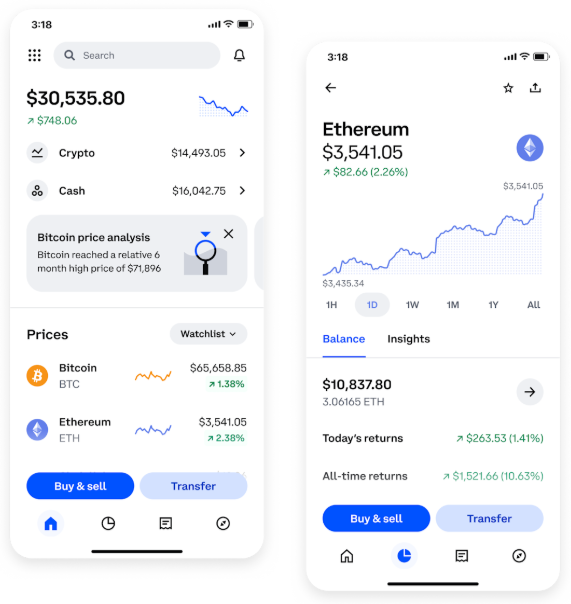

Coinbase User Experience

Coinbase is the Apple of crypto—clean, intuitive, and beginner-focused. The Simple interface lets you buy Bitcoin in three taps. Coinbase Advanced adds charts and orders without overwhelming. The app’s a gem, and “Learn” videos ease you in. Support? Email, chat, and U.S. phone lines are responsive, though X gripes mention delays. My mom could trade on Coinbase—she’d never touch Binance.

Usability Verdict of Binance vs. Coinbase

Coinbase wins for ease, hands-down. Binance’s power suits pros, but its learning curve can frustrate. For low-cost crypto trading, Binance’s fees offset complexity if you’re willing to learn; Coinbase’s simplicity costs more but saves time.

Who’s It For? Finding Your Fit

So, which is the best crypto exchange for low-cost trading? It depends on you:

- Binance: Ideal for active traders, altcoin hunters, or anyone prioritizing fees. If you trade $500 weekly, saving 0.5% vs. Coinbase means $130 yearly. Best for non-U.S. users (Binance.US has fewer coins).

- Coinbase: Perfect for beginners, U.S. traders, or those valuing regulation. If you trade $100 monthly and want zero hassle, the fee hit’s worth the ease.

I use Binance for bulk trades and staking, Coinbase for quick buys when I’m lazy. A friend with $200 sticks to Coinbase—hates Binance’s menus. Your call hinges on budget, goals, and patience.

Hidden Costs and Fine Print : Binance vs. Coinbase

Beyond fees, watch for:

| Platform | Limitations |

|---|

| Binance | – Withdrawal fees can be high (e.g., ~$30 for Ethereum) – BNB fee discounts require holding BNB, which can fluctuate in value – FCA restrictions: U.K. users cannot open new accounts post-2023 |

| Coinbase | – Spread fees make small trades expensive – Coinbase One ($29.99/month) only benefits high-volume traders (> $1,000/month) – Staking banned in some U.S. states (e.g., California) |

Check X for user complaints—Binance gets heat for freezes, Coinbase for surprise fees. Both are solid, but read terms.

Final Verdict of Binance vs. Coinbase

For low-cost crypto trading in 2025, Binance is the clear winner. Its 0.1% fees (0.075% with BNB) crush Coinbase’s 0.4%-2%, saving you $50-$500 yearly on $10,000 in trades. Add 600+ coins, futures, and staking, and Binance delivers value Coinbase can’t match. But Coinbase isn’t out—it’s the best crypto exchange for beginners who’ll pay for simplicity and U.S. compliance. My $100 trades lean Binance for savings, but I keep Coinbase for fast buys. Weigh your priorities—cost vs. ease—and you can’t go wrong.

Want more crypto trading tips? Explore our guides on picking wallets or trading with $100. Got thoughts on Binance vs. Coinbase? Share below or hit us on X (@CryptoGuruReview)!

FAQ: Binance vs. Coinbase for Low-Cost Trading

1. Which exchange has lower fees, Binance or Coinbase?

Binance offers lower fees—0.1% spot trading (0.075% with BNB) vs. Coinbase’s 0.4%-0.6% on Advanced or 1-2% on Simple. For a $100 trade, Binance costs ~$0.10, Coinbase $1-$2. Binance is the best crypto exchange for low-cost crypto trading.

2. Is Binance cheaper than Coinbase for beginners?

Yes, Binance’s 0.1% fee beats Coinbase’s higher rates, even for small trades. But Coinbase’s simple interface might save beginners from costly mistakes, making it worth the extra $1-$2 per trade for crypto trading for beginners.

3. Can I trade with $100 on Binance or Coinbase?

Both allow trading with $100. Binance has no minimum (some coins need $5), and Coinbase starts at $1. Binance saves more on fees, but Coinbase’s ease suits newbies starting low-budget crypto trading.

4. Are Binance and Coinbase safe for low-cost trading?

Both are secure. Binance uses 2FA, cold storage, and SAFU ($1B fund). Coinbase offers 2FA, FDIC-insured USD (up to $250,000), and insurance. Either works for safe crypto trading platforms, but use 2FA and wallets.

5. Which exchange has more coins for trading?

Binance supports 600+ cryptocurrencies, Coinbase 200+. Binance is better for altcoins (e.g., Hedera), while Coinbase covers majors (Bitcoin, Ethereum). For variety in low-cost crypto trading, Binance wins.

6. Do Binance or Coinbase offer staking for extra income?

Yes. Binance offers up to 35% APY on staking (e.g., Solana), Coinbase up to 12% with a 25% commission. Binance’s higher yields suit low-cost crypto trading with passive income.

7. Which is better for U.S. traders in 2025?

Coinbase is better for U.S. traders—fully regulated, FDIC-insured, and simple. Binance.US has 150+ coins but fewer features due to rules. For low-cost crypto trading, Binance.US still beats Coinbase on fees.